Estate Planning 101:

Protecting What Matters Most

A practical introduction to understanding your legacy and Estate Planning basics.

YOU ARE HERE:

Estate Planning Series →Phase 1 Article 1 of 5

At a Glance

Introduction: 101

Estate planning isn’t just about documents and signatures. Rather, it’s about peace of mind. It’s a proactive step that ensures your family, property, and wishes are protected when life takes an unexpected turn.

Many people delay estate planning because it feels complicated, unnecessary, or reserved for the wealthy. Whether you own a home, care for loved ones, or simply want your affairs in order, estate planning gives you control over what happens next.

As families grow more diverse and financial lives expand across digital and physical assets, planning ahead has never been more essential. Clear decisions today can help your loved ones avoid costly court processes, emotional stress, and uncertainty later.

This introductory article will help you understand estate planning basics – the purpose and the power. Our goal is to establish a strong foundation before diving deeper into specific topics like wills, trusts, guardianship, and protecting digital assets in the articles ahead.

At its core, estate planning is the process of organizing your affairs so that your wishes are carried out smoothly—both during your lifetime and afterward.

Not only is It not just about who inherits your property; it’s also about making sure the right people have the right information at the right time.

It applies to anyone who has:

A well-designed estate plan ensures:

Each family’s plan will look different, however, the foundation is the same: preparation and intention.

Why Every Family Needs an Estate Plan

Families today are more complex than ever. For instance, blended households, aging parents, multi-state property, digital assets, caregiving demands, and rising healthcare costs.

That complexity makes estate planning essential. For that reason, a well-structured plan:

📘 Starter Estate Planning Checklist

FREE DOWNLOAD

Feeling overwhelmed? Start small.

The Starter Estate Planning Checklist helps you see what you already have in place and what actually needs attention. View resource →

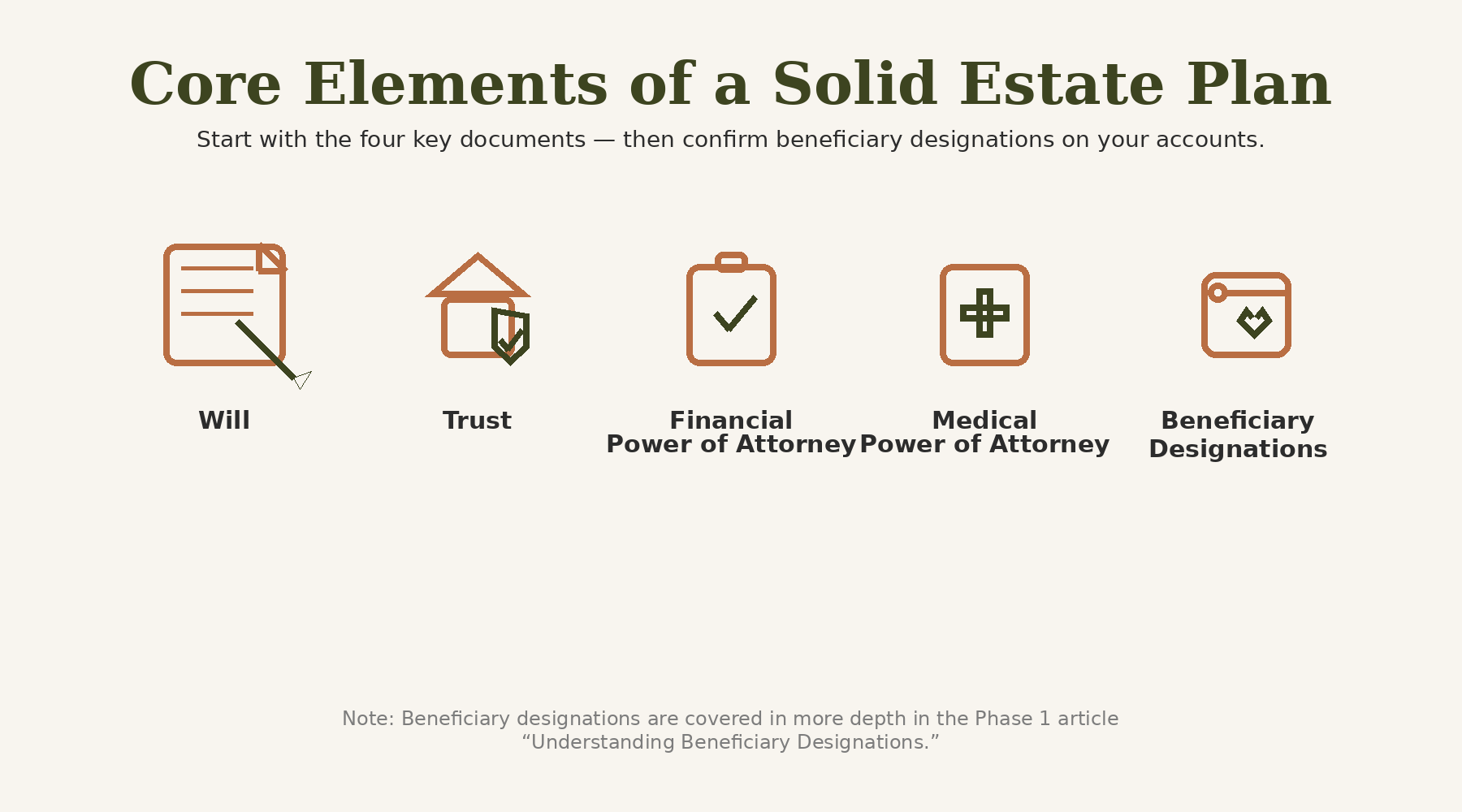

The Core Elements of a Solid Estate Plan

Most families benefit from having these foundational documents:

Together, these documents work as a system—not standalone pieces.

What Happens Without a Plan

If you die or become incapacitated without documents in place, several issues can arise:

However, all of this is avoidable with proper planning.

Key Misconceptions About Estate Planning

Let’s clear up four common misunderstandings:

Where to Start (Simple First Steps)

You don’t need to overhaul everything at once. Begin with these manageable actions:

Now that we’ve established a foundation, the next step is understanding the two core tools (Wills and Trusts) which most families rely on — and how they actually work together.

🛠️ Downloadable Resources

Start with one or two of these simple tools which are designed to help you feel informed, empowered, and ready to take meaningful next steps.

📘 Starter Estate Planning Checklist

FREE DOWNLOAD

A simple list of decisions and documents to help you begin building a basic plan. View resource →

📘 Estate Planning Risk Snapshot

FREE DOWNLOAD

A one-page summary that shows exactly what happens when no documents are in place — court process, costs, delays, and state decisions. View resource →

📘 Estate Planning Glossary

FREE DOWNLOAD

A growing reference of essential estate planning terms to support your learning across the entire series. View resource →

Looking for more estate planning tools?

Explore the full collection on our Estate Planning Resources page.

Next Up: Do I Need a Will, a Trust, or Both?

The next article walks you through the major differences, why most families actually need both, and how each document fits into your long-term plan.

🔍 External Resources & Related Articles

Explore trusted, expert sources or related articles for deeper guidance on the topics covered in this phase.

📚 Trusted External Resources

Organizations listed below provide clear, introductory guidance on estate planning concepts, documents, and decision-making. Their resource hubs are designed for broad learning and ongoing exploration.

🌐 Fidelity — Estate Planning Basics

🌐 Consumer Financial Protection Bureau (CFPB) (.gov) — Managing Someone Else’s Money & Planning Ahead

🌐 FINRED (.gov) – An Introduction to Estate Planning

🌐 AARP — Estate Planning Resources

NOTE: These links are provided for additional education and exploration.

🎯 All Phase 1 Articles

Learn how foundational estate planning works, which tools protect your family, and how to avoid the costly consequences of doing nothing.

📘 Estate Planning 101: Protecting What Matters Most

📘 Do I Need a Will, a Trust, or Both?

📘 What Happens If You Do Nothing?

📘 Why You Still Need a Will (Even with a Trust)

📘 Understanding Beneficiary Designations

JOIN THE COMMUNITY

Sign up & get updates

Join our community to get insights, smart money tips, and tools to help you grow, protect, and elevate your life — one step at a time.

About the Author

Written by Tonya Harris, founder of Elevated Sand. Tonya creates culturally grounded financial and digital education that helps people understand complex topics and make informed decisions for the future.

Disclaimer: Information is for educational purposes only and should not be considered legal or financial advice. Estate planning involves complex legal and tax considerations. You should consult a qualified estate planning attorney to determine the best approach for your situation and ensure compliance with your state’s laws.