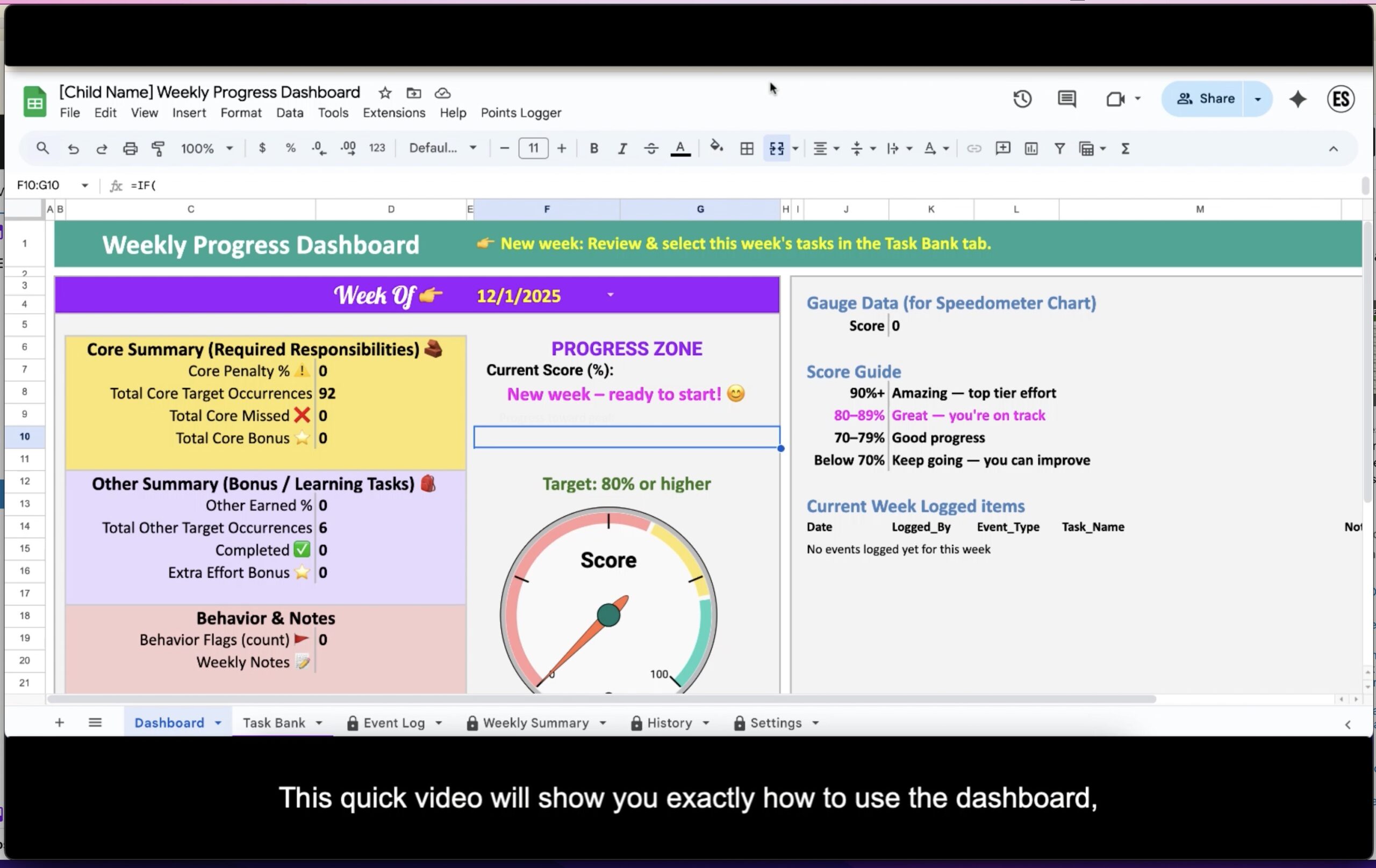

Introduction

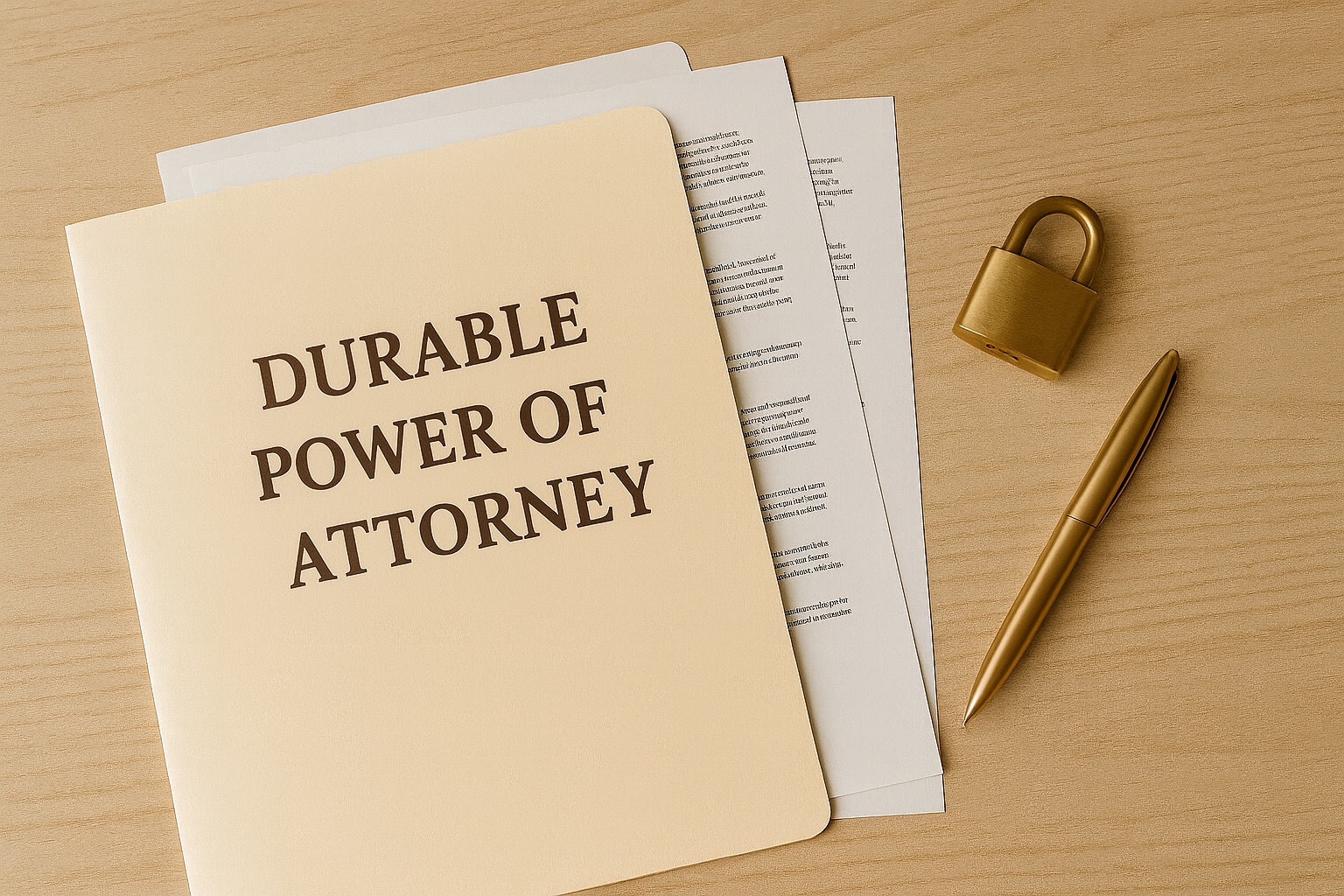

Life can change in an instant. An illness, injury, or unexpected medical event could leave you temporarily—or permanently—unable to manage your own finances. This is where a Durable Power of Attorney (DPOA) becomes one of the most important documents in your entire estate plan.

A durable power of attorney lets you appoint someone you trust to step in and handle your financial affairs if you can’t. Without it, your family may be forced into court-supervised guardianship, which is slow, expensive, and emotionally draining.

This article breaks down what a durable power of attorney is, why you need one, how to choose the right agent, common mistakes to avoid, and what happens if you don’t have one.

In simple terms: a durable power of attorney keeps your financial life moving when you can’t sign your own name.

What Is a Durable Power of Attorney?

A Durable Power of Attorney is a legal document where you (the principal) give someone else (your agent) authority to act on your behalf. When that authority includes finances and legal matters, it’s usually called a financial power of attorney or general power of attorney.

The word “durable” means the authority continues even if you become incapacitated. Without the “durable” language required by your state, the POA may end. A standard (non-durable) POA ends the moment you lose capacity. A durable POA activates or continues during the exact moment you need it most.

- Principal: the person who creates the document and owns the assets.

- Agent / Attorney-in-fact: the person you choose to act for you.

- Durable: the agent’s authority continues during your incapacity, unless the document or state law says otherwise.

Important Note: A durable power of attorney is only valid while you are alive. After death, your executor or successor trustee takes over according to your will or trust.

When Does a Durable Power of Attorney Start and End?

Most states allow you and your attorney to choose when your durable POA becomes effective:

- Immediate POA: Your agent’s authority begins as soon as you sign the document and continues if you become incapacitated.

- Springing POA: Your agent’s authority “springs” into effect only if a certain event happens—often when one or two doctors certify that you’re unable to manage your finances.

Simple example: You sign a durable POA that is effective immediately. You still handle your own finances. But when you later have surgery and can’t sign documents for a few weeks, your agent is already authorized to step in and pay bills on time.

Your POA usually ends when you revoke it in writing, when you pass away, or if your agent becomes unable to serve and there is no backup listed. Your attorney can help you name one or more successor agents so there is a smooth backup plan.

What Can a Durable Power of Attorney Cover?

Your POA can be very broad or very limited. The exact powers depend on your state’s laws and the wording your attorney uses, but common financial powers include authority to:

- Pay bills and manage household expenses

- Access and manage bank accounts

- File tax returns

- Handle insurance matters

- Manage investments

- Make decisions about retirement accounts

- Sell or manage real estate

- Sign financial documents

- Apply for government benefits

Red Flag Warning: Some powers—like changing beneficiary designations or making large gifts—can be especially powerful. Your attorney will help you decide which powers to allow, limit, or leave out.

Your agent must always act in your best interest, keep your finances separate from their own, and keep accurate records.

Real-Life Scenario: Maria suffered a stroke and was unable to speak for several months. Because she had a durable power of attorney in place, her son was able to pay her mortgage, manage her insurance claims, and keep her utilities from being shut off.

🛡️ How a DPOA Protects You if You Become Incapacitated

A properly drafted durable power of attorney can help:

- Avoid guardianship court

- Reduce family conflict

- Keep bills paid on time

- Prevent financial loss or fraud

- Allow a trusted person to make quick decisions

- Protect your credit

- Keep your business running (if applicable)

- Protect real estate, investments, and retirement accounts

Choosing the Right Financial Agent

Because your agent may have access to accounts, property, and sensitive information, who you choose matters just as much as the document itself. Many people choose a spouse, adult child, or trusted friend. Others prefer a professional, especially if family dynamics are complicated.

Strong candidates usually have:

- High integrity and responsibility

- Strong organizational skills

- Understanding of your financial values

- Ability to remain calm in stressful situations

- Financial literacy or willingness to learn

- Availability to step in quickly if needed

Red Flag Warning: Choosing an adult child just because they are the eldest is a common and risky mistake. Focus on who is most capable and trustworthy, not just birth order.

Simple example: Your oldest child is great with money but lives overseas and travels constantly. Your younger child is local, organized, and already helps you with online banking. In practice, the local child may be the better fit as primary agent, with the older child as backup.

⚖️ Durable POA vs. Regular POA vs. Guardianship

It’s helpful to see how a durable power of attorney compares to a regular (non-durable) power of attorney and court-supervised guardianship.

At a high level:

Regular (Non-Durable) POA

- Usually ends if you lose capacity

- Can be useful for short-term or limited tasks

- Not designed for long-term incapacity planning

Durable POA

- Continues if you lose capacity

- Lets you choose your own decision-maker

- Designed to keep your finances moving during a health crisis

Guardianship

- Court appoints a guardian if you have no valid POA

- Can be costly, public, and slow

- Your family may have less control over who is chosen and what they can do

📝 How to Create a Durable Power of Attorney

While the exact steps can vary by state, many people follow a process like this:

- Choose your financial agent (and one or more backups).

- Decide what powers to give your agent and whether the POA should be immediate or springing.

- Work with an attorney to draft a document that follows your state’s laws and reflects your wishes.

- Sign and notarize the document as required in your state.

- Provide copies to your agent, backup agent, and possibly key professionals (such as your financial advisor or CPA).

- Review the document every 3–5 years, or sooner after major life events like marriage, divorce, a move

Simple Example: If your DPOA gives your agent the power to manage real estate, they can sign paperwork to refinance your home or sell a rental property if needed, while you are recovering from surgery or illness.

Red Flags and Common Mistakes

- Waiting too long: If you wait until memory or health issues are advanced, you may no longer have legal capacity to sign a POA.

- Using a generic form without guidance: One-size-fits-all templates may leave out key powers your agent needs—or include powers you never meant to allow.

- Not telling anyone it exists: If your family and key institutions don’t know you’ve named an agent, the document may sit in a drawer during a crisis.

- Choosing based only on birth order: “Oldest goes first” can backfire if that person is overwhelmed, disorganized, or likely to clash with siblings.

- Not naming a backup agent

- Giving too little or too much power without fully understanding the trade-offsNever talking to the person you choose about your expectations and values

- Assuming your spouse automatically has authority with every financial institution

Important Note: If you are worried about potential misuse, talk with your attorney about safeguards—such as requiring two signatures for big transactions or giving a third person the right to request accountings from your agent.

❓ What Happens If You Don’t Have One?

If you become incapacitated without a durable POA, your family may have to file for court-supervised guardianship. This process can be stressful and may lead to:

- Delays in paying bills

- Frozen or restricted accounts

- Missed financial deadlines

- Family disagreements over who should be in charge

- Attorney and court fees

- Loss of privacy as court records become part of the public record in some states

✅ Checklist: What to Do After Creating Your DPOA

- Provide copies to your agent and backup agent.

- Store the original in a safe but accessible place (such as your estate planning binder).

- Upload a digital copy to your secure password manager or vault, if you use one.

- Update financial institutions or professionals as recommended by your attorney.

- Review the document every 3–5 years.

- Update after major life events such as marriage, divorce, the death of an agent, or a significant move.

How a Durable POA Fits into Your Estate Plan

Your will and/or revocable living trust control what happens to your assets after you pass away. Your durable financial power of attorney helps protect those same assets while you are alive but unable to manage things yourself.

- Your durable financial POA helps with day-to-day money decisions and crisis management.

- Your medical power of attorney and living will guide treatment choices and health care decisions.

- Your will and/or revocable living trust control who inherits what and who is in charge after your death.

Ideally, these documents are created together so your agents, executors, and trustees all know their roles and can work as a team.

Final Takeaway

- A durable power of attorney is one of the core documents that keeps your financial life running smoothly if you can’t manage it yourself.

- Choosing the right agent and giving them the right level of authority matters just as much as signing the document.

- Working with a qualified estate planning attorney helps ensure your POA is valid, durable, and coordinated with your will, trust, and medical documents.

Use this article as a conversation starter: Who would you trust to act as your financial backup, and what do they need to know about your accounts, values, and expectations before they ever have to step in?

📚 Additional Resources

This article is part of our Estate Planning Series.

About the Estate Planning Series

A step-by-step educational guide from Elevated Sand that helps you understand wills, trusts, powers of attorney, beneficiary designations, and practical legacy planning—without the jargon.

Further Reading

Explore related guides in this series:

- What Is a Will? – Understand the basics of who inherits what and how.

- What Is a Revocable Living Trust? – See how a trust coordinates with your durable POA.

- Medical Power of Attorney & Living Will Explained – Learn how health care decisions fit into the bigger picture.

Share the Series

If this guide helped you understand how a durable power of attorney works, share the Estate Planning Series Hub with a friend or family member who may benefit.

About the Author

Educator & Founder of Elevated Sand, empowering families to plan confidently.

Tonya Harris is the founder of Elevated Sand, a platform created to help families build confidence around financial and life planning.

She began the Estate Planning Series after realizing that many families postpone these important conversations until it’s too late. Drawing on her background in education and financial literacy, Tonya transforms complex estate planning topics into clear, practical guidance.

Stay Connected!

Disclaimer: This article is for educational purposes only and should not be considered legal, tax, or financial advice. Estate planning, incapacity planning, and financial powers of attorney involve complex legal and tax considerations. You should consult a qualified estate planning attorney and tax professional to determine the best approach for your situation and ensure compliance with your state’s laws.

Table of Contents

- 🏡 Introduction

- ⚖️ What Is a Durable Power of Attorney?

- ⏰ When Does a Durable Power of Attorney Start and End?

- 📋 What Can a Durable Power of Attorney Cover?

- 🛡️ How a DPOA Protects You if You Become Incapacitated

- 👥 Choosing the Right Financial Agent

- ⚖️ Durable POA vs. Regular POA vs. Guardianship

- 📝 How to Create a Durable Power of Attorney

- 🚩 Red Flags and Common Mistakes

- ❓ What Happens If You Don’t Have One?

- ✅ Checklist: What to Do After Creating Your DPOA

- 🧩 How a Durable POA Fits into Your Estate Plan

- ✅ Final Takeaway

- 📚 Additional Resources

- ⚖️ About the Estate Planning Series

- 📚 Further Reading

- 📨 Share the Series

- Stay Connected!