5 Smart Money Moves to Make Before Year-End

Wrap up your finances with clarity and confidence. Consider these Smart Money Moves today for a stronger tomorrow.

End-of-year isn’t just about wrapping gifts — it’s the perfect time to wrap up your finances with clarity. Before the calendar flips, a few small steps can help you save smarter, stress less, and set up for a strong new year. Whether you’re adjusting after unexpected expenses, paying down debt, or planning your next move, these five “money moments” will help you finish strong and start fresh.

Even better: share these tips with your kids — it’s never too early to build smart money habits.

1. Review Your Spending & Subscriptions

Take 15 minutes to scan your bank statements or budgeting app. Are there streaming services, memberships, or apps you don’t use? Cancel or pause them before the next billing cycle. Reinvest that money into savings or a small “fun fund” for family experiences.

💡Pro Tip:

Try the 80/20 method — cut 20% of expenses that bring the least joy.

🎯 Bonus Insight:

This small cleanup can free up $300–$500 a year — funds you can redirect toward an emergency fund or debt snowball.

👧🏽 Kid Connection:

Budget Detective Game — Have your kids look over a list of family expenses (like apps or memberships) and guess which are “needs” vs. “wants.” It’s a fun way to teach value awareness early.

2. Automate One Positive Habit

If saving or debt payments keep slipping through the cracks, automation is your secret weapon. Set up one recurring transfer — even $25/month — toward savings, investments, or debt payoff.

💡Pro Tip:

Rename the account “Future Me” or “Family Goals” to make it feel personal and purposeful.

🎯 Bonus Insight:

Automatic transfers remove the “decision fatigue” that keeps people from saving — what’s out of sight builds wealth in silence.

👧🏽 Kid Connection:

Jar Automation — Create three jars: Spend, Save, Give. Let your kids “transfer” their allowance weekly. This physical act mimics what adults do digitally and helps build consistency.

3. Check Your Credit Report & Utilization

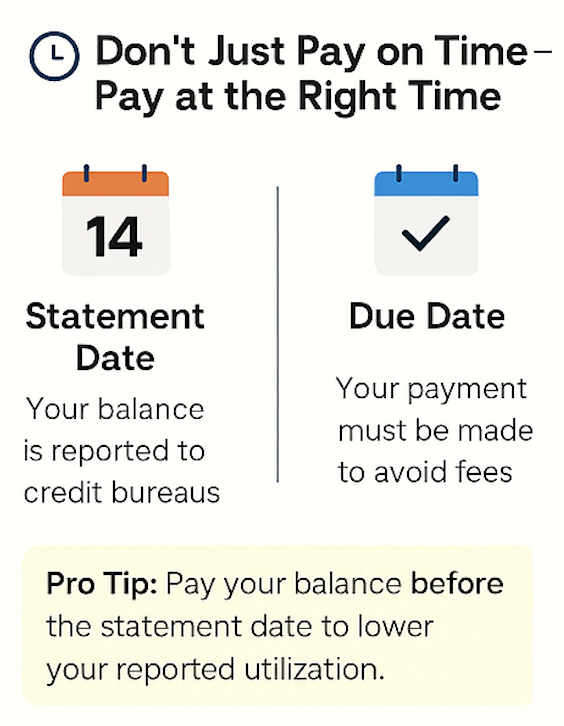

Request your free credit report at AnnualCreditReport.com. Compare your statement date and due date — paying down balances before the statement closes can lower utilization and raise your score.

💡Pro Tip:

Don’t chase perfection — focus on progress.

🎯 Bonus Insight:

Set a phone reminder: “Pay credit cards before statement closes.” It’s one of the easiest hacks to improve your credit without new accounts.

👧🏽 Kid Connection:

Teen Credit Talk — For teens, connect the dots between debit card responsibility and credit in the future. Discuss how credit reflects trust — and how borrowing means paying yourself back later.

4. Update Beneficiaries & Emergency Info

Life changes fast — marriages, births, losses. Check your bank, insurance, and retirement accounts to ensure your beneficiaries reflect your current wishes.

💡Pro Tip:

It’s one of the simplest steps to keep your loved ones protected and your legacy clear.

🎯 Bonus Insight:

Also update emergency contacts on apps, phone, and digital accounts — small details matter in times of crisis.

👧🏽 Kid Connection:

Explain Beneficiaries — Tell kids, “It’s how we choose who gets to help with our things if something happens.” This builds understanding about planning, responsibility, and trust.

5. Set a Micro-Goal for the Next Quarter

Choose one small, measurable goal:

- Launch a side project

- Pay down $200 of debt

- Save $300

- Open a Roth IRA

💡Pro Tip:

Celebrate completion, not perfection. Write your goal where you can see it.

🎯 Bonus Insight:

Micro-goals create momentum. A small win releases dopamine — the “motivation molecule” that keeps habits alive.

👧🏽 Kid Connection:

Goal Jar Challenge — Let your child pick one “goal jar” (toy, book, trip). Add coins weekly. When they reach it, celebrate together — it teaches patience, progress, and reward.

JOIN THE COMMUNITY

Sign up & get updates

Join our community to get insights, smart money tips, and tools to help you grow, protect, and elevate your life — one step at a time.

Disclaimer: This content is provided for educational and informational purposes only and does not constitute legal, financial, or professional advice. Requirements, laws, and practices may vary by location and situation. Readers are encouraged to verify information independently and consult qualified professionals for guidance specific to their needs.